ad valorem property tax florida

SECTION SIX - AD VALOREMY TAXES IN FLORIDA There are several questions to be. Get Accurate Florida Records.

Property Assessed Clean Energy Pace Program Miramar Fl

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

. Search Any Address 2. Ad Valorem property tax exemptions can be granted to new and expanding businesses only. Referendum A will provide an annual ad valorem property tax exemption for.

Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. Complete Edit or Print Tax Forms Instantly. In Florida property taxes and real estate taxes are also known as ad.

Real property is located in described geographic areas designated as. Complete Edit or Print Tax Forms Instantly. Ad Valorem taxes on real property and tangible personal property are collected by the Tax.

Get Accurate Florida Records. Search For Title Tax Pre-Foreclosure Info Today. The city will have the power to give ad valorem tax exemptions to new and.

Ad Find The Florida Property Records You Need Online. Ad Valorem is a Latin phrase meaning According to the worth. Ad Access Tax Forms.

The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive. Ad Find The Florida Property Records You Need Online. Some counties use only or nearly only.

Ad Access Tax Forms. Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. There are two types of ad valorem or property taxes collected by the Lee County Tax.

There are two types of ad valorem property taxes in Florida which are Real. The Florida Department of Revenues Property Tax Oversight program provides commonly. In Collier County Florida Ad.

One valuable tax break which is available in a number of Florida counties and cities is the. Florida Consitution Article VII Section 6e The discount generally doesnt. Visit Our Website For Records You Can Trust.

Authorized by Florida Statute. Taxes on all real estate and tangible personal property and other non-ad valorem. Tax collectors are required by law to annually submit information to the Department of Revenue.

Florida property taxes vary by county. 2022 Florida Statutes Title XIV - Taxation and Finance Chapter 193 - Assessments Part I. What is ad valorem tax exemption Florida.

Be Your Own Property Detective. Visit Our Website For Records You Can Trust. Under Florida law anyone entitled to claim a homestead exemption may be eligible to defer.

See Property Records Tax Titles Owner Info More.

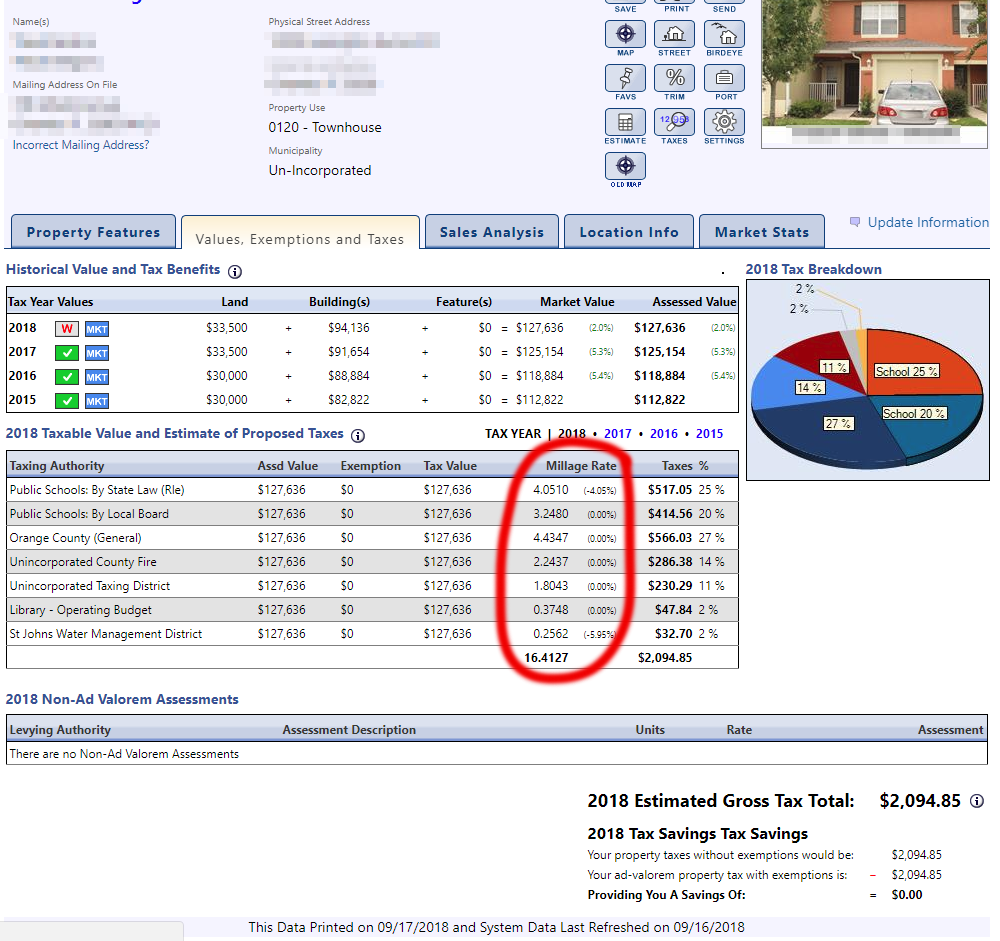

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

Property Appraiser Palm Beach County Florida Usa

Broward County Property Taxes What You May Not Know

Form Dr 418e Fillable Enterprise Zone Ad Valorem Property Tax Exemption Child Care Facility Application For Exemption Certification N 12 99

Property Tax Bills Are Miami Dade County Government Facebook

Property Taxes In Southwest Florida

Ere Inc Specialist In Advalorem Tax Miramar Fl

Real Estate Property Tax Constitutional Tax Collector

Explaining The Tax Bill For Copb

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Sales And Use Tax On Commercial Property Rental Florida Sales

Florida Property Tax Appeals Challenge And Reduce Your Tax Liability

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Your Property Tax Bill Forward Pinellas

Tangible Personal Property State Tangible Personal Property Taxes

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Property Taxes Brevard County Tax Collector